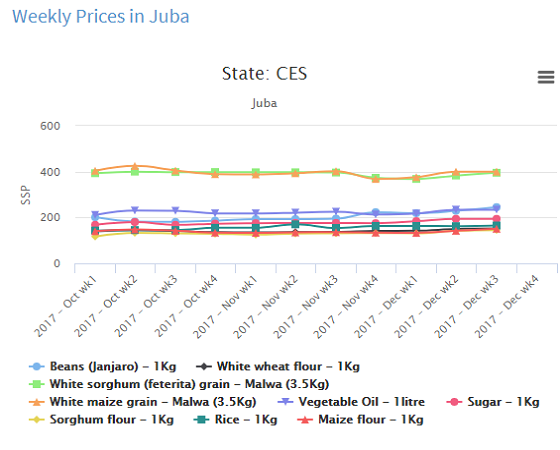

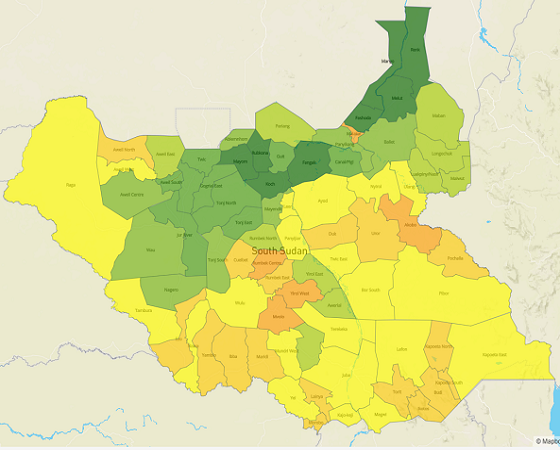

Markets

Monitoring of market prices of major agricultural and livestock products is critical to address the supply and demand pattern and access dimension of food security. Efficient, reliable, accurate and well analyzed market information is an important component of Early Warning systems for food security as it can assist in identifying areas of possible shortages which are reflected by higher prices and can highlight whether prices are above or below normal seasonal trends. It can also assist government planners in developing an understanding of the ways markets work

The Market Information Systems (MIS) network has been existing in the country for four years and FAO has been at the forefront in data collection, processing and dissemination of market data. Over time, FAO has moved from facilitating the collection of the market data through focal persons attached to the State Departments of Agriculture to development of a centralized system which assists in the collation of the collected data while providing real-time basic analysis of the data. Furthermore, FAO has continued to increase internal capacity in order to support further the market data collection efforts through further development of CLiMIS, deployment of a mobile system for data collection and carrying out of training workshops to increase the technical capacity of all partners involved in market data related activities.

Reports

COVID-19 Impact on Markets and Trade in South Sudan, 06 April 2020

Apr 7th 2020Key highlights include:-

• Market prices have started to rise, driven by panic buying amidst fears of COVID-19 related border closures and movement restrictions.

• The government’s decision to leave the border open to trucks bringing in essential goods to South Sudan will be key in ensuring a steady supply of commodities and slowing down the rate of price increases in the markets.

• Oil production is likely to continue uninterrupted in the near term, but income will be reduced due to the ongoing oil price crisis. This will impact on cross-border trade because of hard currency scarcity.

• Closure of businesses considered non-essential will impact negatively on incomes for traders and associated sectors. This will likely result in a decrease of food supply and demand because of reduced consumer purchasing power.

• Rural markets are at risk of being disrupted by COVID-19 related movement restrictions, and this will impact market access and income earning opportunities for rural populations, further increasing their vulnerability.

Warrap Market Assessment, November 2018

Mar 7th 2019This assessment was conducted in Kuajok, Tonj town, Akon, Thiet, Lunyaker, Liethnhom and Warrap markets in Warrap state. It was aimed at understanding the key sources of commodity supply by market and by season; availability of staple food commodities on local markets; the trade volume of staple food transacted on the markets; the price setting behaviors; the markets’ potential for responding to increased demand; and propose the appropriate response options.

DownloadWFP South Sudan Monthly Market Prices Bulletin, October 2018

Nov 26th 2018From July 2018, the retail prices of staple cereal have started to decrease in most markets, and this downward trend has continued in September. This decrease in staple prices is associated with the currency appreciation, as well as the decrease in consumer demand with the harvest season and an increase in commodity supply to the markets at the beginning of dry season. Government has continued the sale of food at subsidized prices at first come first served basis to consumers in Juba town. The retail prices of sugar, maize flour, red beans, wheat flour, rice and vegetable oil at subsidized shops were lower than market prices by 29 to 57 percent

DownloadWFP South Sudan Monthly Market Prices Bulletin, August 2018

Sep 3rd 2018In July, staple food commodities in most monitored markets experienced stability or decrease which is atypical during this season of the year, when these commodities are typically their most expensive. Despite the observed stability and decrease, prices stood at their elevated levels and significantly higher than the same time one year ago. The coincidence of currency appreciation, availability of green vegetables, distribution of in-kind food assistance, and the seasonal decline in prices of staple grain in Uganda, could be contributing to this stability and decrease in prices.

DownloadWFP South Sudan Monthly Market Prices Bulletin, July 2018

Aug 13th 2018In June, the nominal price of staple food commodities showed moderate increase in most of the monitored markets. For instance, sorghum price increased in the range of five to nine percent in Bor, Aweil, Wau and Bunj; while it increased by 84 percent in Yida. In the capital, Juba, the sorghum price remained unchanged from the previous month. Compared to May, ToT between goat and sorghum improved in Aweil (24 percent) and Juba (100 percent) due to increase in price of goat higher than that of sorghum. In Northern Bahr el Ghazal, competition between traders from local and neighboring state in Sudan contributed to the increase in prices of livestock. On the contrary, Wau and Yida experienced deterioration in terms of trade due to drop in goat price coupled with increase in sorghum price.

DownloadWFP South Sudan Monthly Market Prices Bulletin, June 2018

Jul 23rd 2018The cost of standard food basket continued its increasing trends. The increase in the last few months could be associated mainly with the depreciation of local currency and the progress of the rainy season. In May 2018, Lakes, Central Equatoria and Northern Bahr el Ghazal were the three locations with the highest cost of the food basket. More than half of monitored markets experienced increase in cereal prices compared to the previous month. High transport cost associated with the rainy season could be a reason for the observed price upsurges. Rapid variation has been observed in fuel prices, especially in markets getting supply through informal cross border trade. In May, record high fuel price was observed in Aweil for diesel (SSP 740/L) and in Bunj for petrol (SSP 900/L), increases of 119 percent and 35 percent, respectively as compared to April 2018. It was mainly due to delay in supplies to petrol stations due to poor road conditions in the rainy season.

DownloadWFP South Sudan Monthly Market Prices Bulletin, April 2018

May 21st 2018The price of the staple cereal, sorghum, rose in Torit, Rumbek, Aweil and Wau markets by 14 to 35 percent compared to one month ago. Despite the rise in currency exchange rates, the price of staples, including imported, showed stability and even decreased in some of the markets, which could be attributed to the availability of humanitarian assistance. Higher increase in prices of goat compared to sorghum caused an improvement in ToT in 60 percent of the monitored markets, while 30 percent of monitored markets experienced deterioration due to increase in sorghum prices that outweighed goat prices. Compared to the same period last year, ToT have shown improvements in all locations.

DownloadQuarterly GHA Cross Border Trade Bulletin, April 2018

Apr 27th 2018In Eastern Africa, staple commodity prices generally followed seasonal trends in Uganda, Kenya, and Somalia, but atypical price trends were observed in Sudan, South Sudan, Ethiopia, and Tanzania (FEWS NET Price Watch, March 2018). Prices are expected to follow seasonal trends through June 2018, remaining below last year and five year USD prices due to a combination of currency depreciation, better production than 2017, and regional imports.

DownloadWFP South Sudan Monthly Market Prices Bulletin, March 2018

Apr 24th 2018The average exchange rate of United States Dollar to South Sudanese Pound stood at SSP 220 and SSP 133 in the parallel and official markets in February 2018, compared to SSP 211 and SSP 131 respectively in the previous month. The divergence of the parallel exchange rate from the official rate reached a new high of 66 percent in February. The cross-border trade between Sudan and South Sudan was opened. The opening of the border has however not resulted in a decrease in prices of food imported from Sudan, reportedly due to the multiple checkpoint payments along trade routes. The staple cereal prices showed mixed behavior in February. Prices of sorghum increased in Aweil, Torit and Mingkaman - ranging between 13 to 28 percent; while it remained stable in other markets.The cost of a standard food basket to meet the minimum daily recommended energy requirement (2,100 kilo calories) was highest in the Lakes region, followed by Jonglei while lowest in Eastern Equatoria.

DownloadSouth Sudan Monthly Market Price Monitoring Bulletin, January 2018

Feb 28th 2018Intermittent seasonal harvests coupled with humanitarian food assistance have contributed to a decrease in prices of sorghum, maize grain and maize flour in many markets. Compared to previous month, the price of the main staple cereal, white sorghum, has decreased in the range of 12 to 22 percent in Yida, Torit, Rumbek and Wunrok, while markets of Juba, Bor, Bentiu, Kapoeta South and Wau have observed stable prices. The seasonal factor has also caused a decrease in prices of maize grain and maize flour in most of the monitored markets.

DownloadSouth Sudan Monthly Market Price Bulletin, November 2017

Jan 4th 2018According to The Sudan Tribune, South Sudan has removed fuel subsidies due to scarcity of hard currencies to subsidize fuel prices. The removal of subsidies might open an opportunity to private companies to import and sell at free market prices, which is likely to ease availability. In October 2017, price of petrol decreased in many markets by 8 to 33 percent compared to the previous month. The petrol price ranged from SSP 200 per litre in Agok to SSP 400 per litre in Wunrok.

DownloadSouth Sudan Juba Bi-Weekly Price Watch, March 2017, Week 2

Mar 26th 2017The 2nd week of March 2017 saw most commodity prices in Juba stabilize with the exception of beans (Janjaro) that showed an increase of 7 % compared to the previous week. The stability of prices is attributed to a significant drop in the transportation costs as a result of availability and access of fuel at the pump price of SSP 22 instead of the exorbitant prices charged in the fuel black market.

DownloadSouth Sudan Juba Bi-Weekly Price Watch, December 2016, Week 4

Jan 16th 2017Although the prices of most commodities decreased in week 4 of December 2016, prices remained higher compared with the previous month. Month-on-month prices remained higher within the ranges of 8 – 61%. Food commodity prices were 16 – 56% higher than the previous three months. The prices were 196 – 347 % and 207 – 362 % compared to last year and the past four year average respectively.

DownloadWFP South Sudan Monthly Market Prices Bulletin, September 2016

Jan 16th 2017Inflation: The South Sudan August 2016 inflation rate peaked to an all-time higher of 730 percent year-on-year, 70 points more than the 661 percent in July, due to an 850 percent rise in the cost of food and non-alcoholic beverages. Exchange Rate: The South Sudan Pound hit a record low against the U.S. dollar in August 2016, exchanging at SSP 67/1$ in Juba down from SSP 65/US$ a month earlier. The SSP has lost further ground to the dollar in the first week of September exchanging at SSP 80/US$ in the black market in Juba.

DownloadWFP South Sudan Monthly Market Prices Bulletin, October 2016

Jan 16th 2017Due to bulk supply of fuel to Juba during the reporting month, prices of petrol/ diesel in the flourishing black market stabilized in Juba, Kapoeta, Torit, Bor and Minkaman. However, fuel prices went up in the hinterland markets of Yida, Bentiu, Rumbek and more than doubled in Aweil month-on month due to erratic supply and scarcity. Fuel shortages and impassible roads due to rains and insecurity continued to impede domestic trade flows.

DownloadSouth Sudan Juba Bi-Weekly Price Watch, August 2016, Week 4

Sep 20th 2016There are some marginal drops in prices of some food commodities in Juba markets when compared to the previous two weeks. Sorghum flour dropped the most by 16% because of its increased supply in the market following its harvest in neighbouring counties. Prices of both white wheat flour and sugar also dropped by 13% because of improved flows of imports form Nimule to Juba. Maize flour has also seen a 9% drop in price, equally attributed to the availability of dry maize harvests in Juba markets.

DownloadSouth Sudan Juba Bi-Weekly Price Watch, July 2016, Week 4

Aug 8th 2016The prices of most commodities in Juba markets remained high but slightly lower compared to the previous two weeks immediately after the recent conflict. The slight decrease in prices is attributed to the opening of the Nimule border, which resulted in some stocks finding their way into the country. However, there is still a net deficit, which is attributed to fewer traders since many foreign traders have left due to insecurity; traders who lost their stocks are unable to re-stock adequately; and there is continued scarcity of hard currency, which limits the quantities of imports.

DownloadSouth Sudan Juba Bi-Weekly Price Watch, June 2016, Week 4

Jul 26th 2016The prices of most commodities in Juba market remained stable on week 4 of June compared with the previous week because most traders had not depleted their last week’s stocks. This stability of prices was observed for a Malwa of white sorghum grain, 1kg of wheat flour, 1kg of beans (janjaro), 1kg of sugar, 1kg of sorghum flour and a litre of vegetable oil. The 20% increase in the price of a Malwa of white maize grain is attributed to high taxes levied on the imported grain in addition to the scarcity of hard currency.

DownloadWFP South Sudan Monthly Market Prices Bulletin, July 2016

Jul 26th 2016The Bulletin also looks at the impact on the conflict in Juba on prices. The bulletin provide a table on the last page showing the price changes compared to one year ago and a month ago. Given the inflationary environment, the economic problems and the conflict, prices have continued increasing in most markets. The price increases will negatively impact on food security for the poor in both rural and urban areas

Download CLiMIS

CLiMIS